This pattern should signal a warning that the company is in financial distress. The company is not only not generating a positive cash flow from operations but is not getting financed either. A cash flow analysis shows if your business is adequately capitalised in other words it has enough cash to meet its requirements. Performing ratio analyses each month will give you a concrete way to measure how well your business is managing your cash. This can give insight on a number of cash flow items. In addition it can also help you gauge the best times to buy equipment or make other capital expenditures. Preparing Your Cash Flow Statement. In fact it is disbursing funds to lenders. Coca-Colas statement of cash flows would provide detailed information regarding this increase. To begin youll need a years worth of company financial data.

Coca-Colas statement of cash flows would provide detailed information regarding this increase. The Trend CFS Analysis requires at least 4 years of past CFS for effect. This would provide 3 years of trend in PAT and Cash PAT the twin engines for cashflow sustainability tests. Performing ratio analyses each month will give you a concrete way to measure how well your business is managing your cash. In a similar fashion to an income statement analysis many items in the cash flow statement can be stated as a percent of total sales. Free cash flow analysis is the amount of cash that a company can put aside after it has paid all of its expenses at the end of an accounting period. Then you can create three key ratios from figures on your income statement. A cash flow analysis is a method for examining how a business generates and spends money over a specific period of time. Instead of direct shipments to. Chapter 12 How Is the Statement of Cash Flows Prepared and Used covers the statement of cash flows.

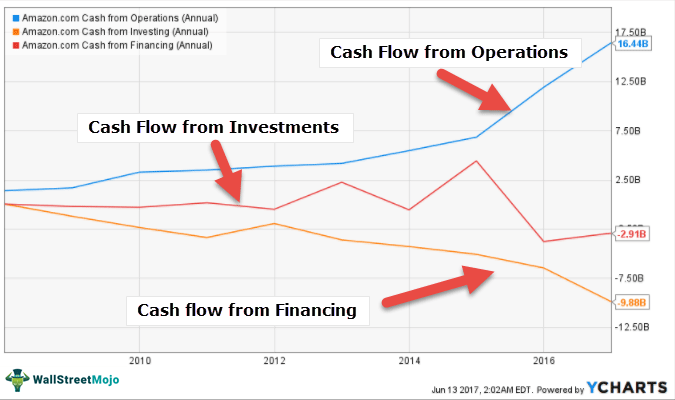

Free Cash Flow Analysis Definition. Performing ratio analyses each month will give you a concrete way to measure how well your business is managing your cash. Then you can create three key ratios from figures on your income statement. Free cash flow Net cash flow from operating activities capital expenditures dividends. One of the best ways to track a businesss health is by analyzing cash flow trends. The Trend CFS Analysis requires at least 4 years of past CFS for effect. Pattern 8 is the worst pattern for cash flow statement analysis. In fact it is disbursing funds to lenders. This would provide 3 years of trend in PAT and Cash PAT the twin engines for cashflow sustainability tests. Free cash flow analysis is the amount of cash that a company can put aside after it has paid all of its expenses at the end of an accounting period.

Cash Flow Analysis Example. Calculation of Free Cash Flow. One of the best ways to track a businesss health is by analyzing cash flow trends. Chapter 12 How Is the Statement of Cash Flows Prepared and Used covers the statement of cash flows. The Trend CFS Analysis requires at least 4 years of past CFS for effect. In addition it can also help you gauge the best times to buy equipment or make other capital expenditures. Simply put free cash flow is the cash that a company has left after it pays for any capital expenditures it. Coca-Colas statement of cash flows would provide detailed information regarding this increase. A cash flow analysis allows you to assess your businesss financial health to determine certain cash flow patterns and potential issues. The company is not only not generating a positive cash flow from operations but is not getting financed either.

Coca-Colas statement of cash flows would provide detailed information regarding this increase. In fact it is disbursing funds to lenders. Pattern 8 is the worst pattern for cash flow statement analysis. Growing discrepancy between net income and cash flows Premature recognition of revenues At a later date AR written off IBM in early 1990s. It can help you figure out where your money is going and how much cash you have available at a given moment. This would provide 3 years of trend in PAT and Cash PAT the twin engines for cashflow sustainability tests. Coca-Colas statement of cash flows would provide detailed information regarding this increase. Chapter 12 How Is the Statement of Cash Flows Prepared and Used covers the statement of cash flows. One of the best ways to track a businesss health is by analyzing cash flow trends. Over-booked revenues from leases and shipments to distributors Bausch and Lomb New sales strategy in 1993.