IAS 244 A related party relationship might have commenced or ceased during the reporting period. The nature of the related party relationship. Previous Guidelines superseded Master Circular on Disclosure in Financial Statements Notes to Accounts issued vide DBODBPBC. The amount of the related party transactions. This Statement should be applied in reporting related party relationships and transactions between a reporting enterprise and its related parties. Statements and areas involving a higher degree of judgement or complexity are disclosed in Note 4. Related party transactions are conducted with other parties with which an entity has a close association. Examples of related party transactions include transactions between a a parent company and its subsidiary. For this purpose ICAI issued AS-18 Related Party Disclosure. This is mandatory to all companies.

Where transactions have not been concluded under normal market conditions the small company must disclose. Need for judgement Specific guidance on materiality and its application to the financial statements is. A the domicile and legal form of the company its country of incorporation and the address of the registered. Report all related party transactions that are material to the financial statements. If the value of a dormant companys related party transactions disclosed in the financial statements for the financial period exceeds S15 million it should submit Form C by Form C Upload mode instead of Form C-S for the Year of Assessment 2019. The ordering of notes to the financial statements how the disclosures should be tailored to reflect the reporting entitys specific circumstances and the relevance of disclosures considering the needs of the users. Identify the related party relationships and transactions which exist within the AB Ltd Group and needs to be disclosed in the financial statements of the entity for the year ended 31 December 2011. Also explain why it is important to disclose related party relationships and transactions with such parties. Purpose of related party disclosures. Entitys separate or individual financial statements.

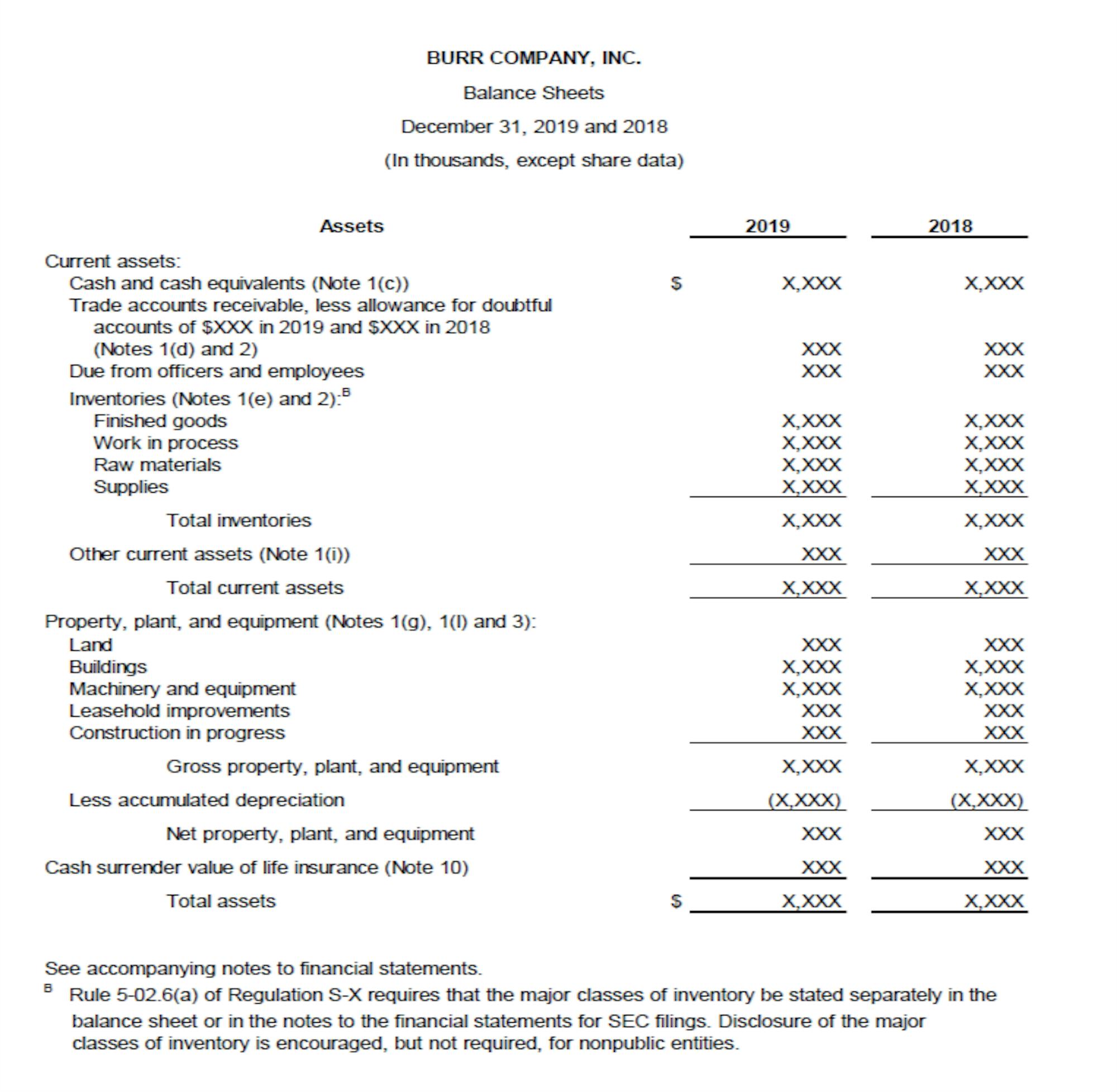

Statements and areas involving a higher degree of judgement or complexity are disclosed in Note 4. Entitys separate or individual financial statements. The objective of IAS 24 is to ensure that an entitys financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions and outstanding balances including commitments with such parties. Nonpublic companies but disclosure of the nature of significant reconciling items required ASC. Identify the related party relationships and transactions which exist within the AB Ltd Group and needs to be disclosed in the financial statements of the entity for the year ended 31 December 2011. Examples of related party transactions include transactions between a a parent company and its subsidiary. The amount of the related party transactions. For each related party disclosed in Note 19 include a separate paragraph presenting the following information. Also explain why it is important to disclose related party relationships and transactions with such parties. In addition to disclosing the nature of the related party relationship and information about the transactions outstanding balances and commitments necessary for an understanding of the effect of the related party relationship on the financial statements a reporting entity is also required to disclose.

To know the effect of this relation on financial statement one must know this relation. Intragroup related party transactions and outstanding balances are eliminated except for those between an investment entity and its subsidiaries measured at fair value through profit or loss in the preparation of consolidated financial statements of the group. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS13. For this purpose ICAI issued AS-18 Related Party Disclosure. The following items need not be disclosed in the financial statements if they are disclosed elsewhere in the information published with the financial statements. A the domicile and legal form of the company its country of incorporation and the address of the registered. Related party transactions. Purpose of related party disclosures. The entire disclosure for related party transactions. This also affords an effective implementation of Philippine Accounting Standards PAS 24 Related Party Disclosures which directs entities to make general disclosures of RPTs in its notes to audited financial statements without necessarily specifying the name of related parties.

This Statement should be applied in reporting related party relationships and transactions between a reporting enterprise and its related parties. Purpose of related party disclosures. The disclosures are purely for illustrative purposes and may. For each related party disclosed in Note 19 include a separate paragraph presenting the following information. The entire disclosure for related party transactions. The nature of the related party relationship. For this purpose ICAI issued AS-18 Related Party Disclosure. The ordering of notes to the financial statements how the disclosures should be tailored to reflect the reporting entitys specific circumstances and the relevance of disclosures considering the needs of the users. Where transactions have not been concluded under normal market conditions the small company must disclose. C and entity and its principal owners.