For further information please contact. IFRS 16 sets out a comprehensive model for the identification of lease arrangements. Elimination issue to deal with on consolidation. Explore the unspoken challenges of IFRS 16. The corporation is a lessee in most of its leases but also acts as a lessor. The amendments provide lessees who have received rent concessions as a direct consequence of the Covid 19 pandemic with an exemption from the requirement to assess whether the concession is a lease modification. It can be applied before that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. Currently IFRS 16 is all the rage and if youre not talking about it you. Yes the accounting for leases by lessors and lessees is completely different and therefore there is no easy way do approach the consolidation. IFRS 16 IFRS 16 par.

Asset user lessee. The lease transfers ownership of the asset to the lessee by the end of the lease term. IFRS 16 was originally amended in 2020 for Covid-19-related rent concessions. In fact there isnt just one big deal but several little deals and this is exactly why this standard is so complex. Elements of cost Under the cost model a right-of-use asset is measured initially at cost discussed above less any depreciation and any accumulated impairment losses IFRS 1630. While this gross up in total assets and total liabilities is the most obvious impact of adopting IFRS 16 there are a. Modified retrospective option 2 as if IFRS 16 is always applied for right of use asset Netting of deferred taxes in presentation compulsory if conditions are met. In the wake of its publication the IFRS 16 standard has caused a ripple among financial departments who expect to see major changes not only in finances and accounting but also in terms of data processing. For example you can reverse all the entries made by lessee in consolidation journal and account for the lease as if IAS 17. 219 Do you have any comments on the impacts IFRS 16 will have on consolidation.

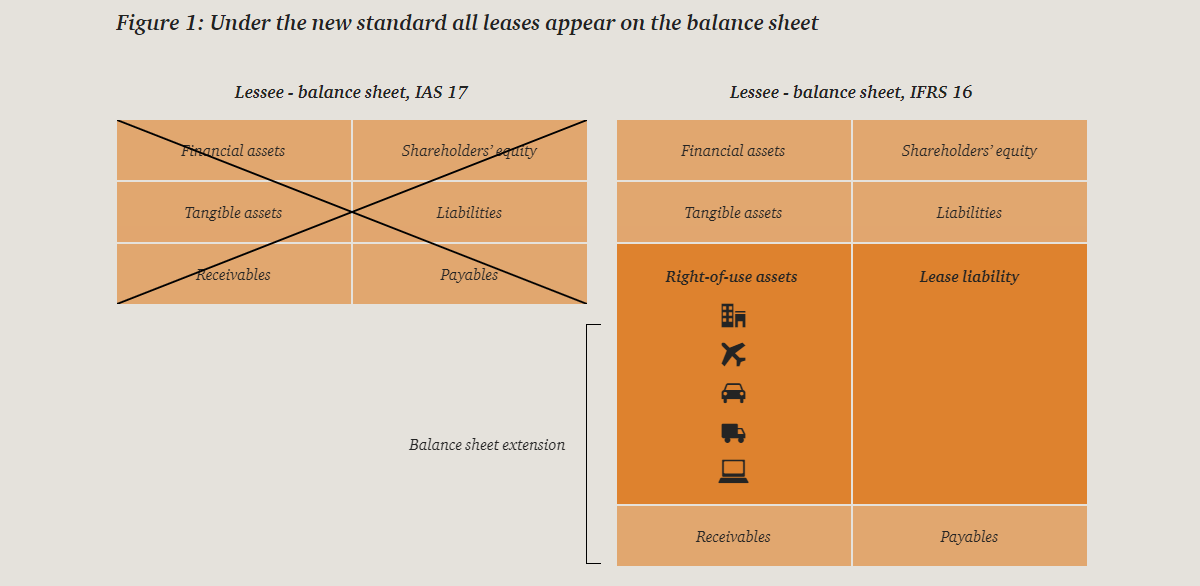

Avni Mashru PwC Real Estate Accounting leader talks through some of the forgotten areas of IFRS 16 Leases. Under IFRS 16 intercompany leases will not eliminate automatically on consolidation IFRS 16. IFRS 16 Leases interaction with other standards At a glance Under IFRS 16 lessees will need to recognise virtually all of their leases on the balance sheet by recording a right of use asset and a lease liability. In fact there isnt just one big deal but several little deals and this is exactly why this standard is so complex. A reporting entity is required to consolidate an investee when that entity controls the investee. Book-to-tax difference of. IFRS 16 IFRS 16 par. Disclosure in the financial statements remains necessary. Modified retrospective option 2 as if IFRS 16 is always applied for right of use asset Netting of deferred taxes in presentation compulsory if conditions are met. Explore the unspoken challenges of IFRS 16.

In fact there isnt just one big deal but several little deals and this is exactly why this standard is so complex. Reporting Consolidation Expert Adeline Arana gives us a glimpse of whats new and explains the challenges of the new regulation. By Marek Muc Tue Aug 11 2020 241 pm. One simple intra-group lease. IFRS 16 Leases interaction with other standards At a glance Under IFRS 16 lessees will need to recognise virtually all of their leases on the balance sheet by recording a right of use asset and a lease liability. A reporting entity is required to consolidate an investee when that entity controls the investee. TOKYO July 29 2021--Renesas Electronics Corporation today announced consolidated financial results in accordance with IFRS for the six months ended June 30 2021. 220 Do you agree with the proposals for aligning the accounting of service concession arrangements that contain a lease with IFRS 16. Currently IFRS 16 is all the rage and if youre not talking about it you. 80 taxable temporary difference.

TOKYO July 29 2021--Renesas Electronics Corporation today announced consolidated financial results in accordance with IFRS for the six months ended June 30 2021. It can be applied before that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. 219 Do you have any comments on the impacts IFRS 16 will have on consolidation. Like IAS 27 and SIC-12 the consolidation model in IFRS 10 is based on control. IFRS 16 IFRS 16 par. By Marek Muc Tue Aug 11 2020 241 pm. IFRS 16 sets out a comprehensive model for the identification of lease arrangements. Under IFRS 16 intercompany leases will not eliminate automatically on consolidation IFRS 16. The corporation is a lessee in most of its leases but also acts as a lessor. In the wake of its publication the IFRS 16 standard has caused a ripple among financial departments who expect to see major changes not only in finances and accounting but also in terms of data processing.