The balance sheet shows if companys activity is mainly financed by. Balance Sheet of a company shows the total assets such as plant machinery office furniture etc that a company has which is used by them to produce goods and services. It gives us the information on the asset liability and shareholders equity on a particular day. A central bank balance sheet is usually analysed from the twin angles of the ability to issue currency and the ability to achieve the monetary policy objectives of price stability and growth. SLR is prescribed by the Reserve Bank of India. But the balance sheet report tells the status of assets liabilities equity from the day a company is formed. The balance sheet together. Better utilization of finances ultimately leads to more profitability and cash flows. CFA Level I - CBT Mock Exams. Here do not get confused by the term shareholders equity.

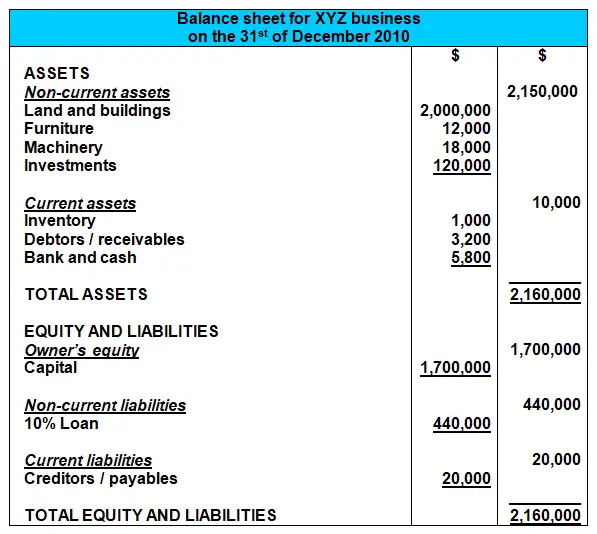

Tips for Understanding Financial Statements Small businesses can read their balance sheets to better understand the companys accounts at a specific moment in time. It is a snapshot of your companys financial position at the end of a specified date. Understanding Balance Sheet and other Financial Statements Tuesday November 20 2018 930 am. It gives us the information on the asset liability and shareholders equity on a particular day. Assets Liabilities Shareholders Equity. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement. Assets in a banks balance sheet. Better utilization of finances ultimately leads to more profitability and cash flows. A companys balance sheet can reveal the actual value or the net worth of the company and. The balance sheet adheres to the following formula.

Assets in a banks balance sheet. A companys balance sheet can reveal the actual value or the net worth of the company and. SLR is prescribed by the Reserve Bank of India. At its simplest a balance sheet shows what assets your company controls and who owns them. The balance sheet together. Owners equity or capital. SLR stands for Statutory Liquidity Ratio. A central bank balance sheet is usually analysed from the twin angles of the ability to issue currency and the ability to achieve the monetary policy objectives of price stability and growth. CFA Level I - QA Review Sessions. The balance sheet is a measure of the solvency of the business.

Talking about the balance sheet in more colloquial terms we can say that it tells how a company has handled its finances. Here do not get confused by the term shareholders equity. It shows what your business owns assets what it owes liabilities and what money. A companys balance sheet can reveal the actual value or the net worth of the company and. A central bank balance sheet is usually analysed from the twin angles of the ability to issue currency and the ability to achieve the monetary policy objectives of price stability and growth. It is like a report card to measure a companys performance. Balance Sheet along with the Income Statement and the Cash Flow statement forms the three primary financial statements in accounting. CFA Level I - Question Bank. SLR stands for Statutory Liquidity Ratio. CFA Level I - QA Review Sessions.

It shows what your business owns assets what it owes liabilities and what money. Better utilization of finances ultimately leads to more profitability and cash flows. In order to track the channel of transmission of monetary policy most monetary authorities redraw the assets and liabilities from their balance sheet. And if youre concerned with not bankrupting your new store I TOLD you selling piranhas online would never work its a pretty important statement to understand. CFA Level I - QA Review Sessions. Cash is self explanatory. How to Read Analyze a Balance SheetLearn the stock market from the basics to advance and become an expert investorThe financial statement is one of the cr. Balance Sheet of a company shows the total assets such as plant machinery office furniture etc that a company has which is used by them to produce goods and services. It is like a report card to measure a companys performance. Owners equity or capital.