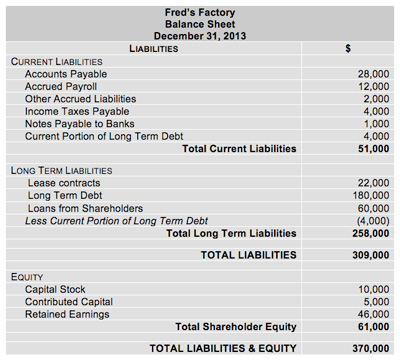

Provisions include warranties income tax liabilities future litigation fees etc. The main use of warranty liability is in a companys accounts specifically its balance sheet. As actual warranty claims are received debit the warranty liability account and credit the inventory account for the cost of the replacement parts and products sent to customers. All Liabilities of Sellers with respect to product warranties relating to products sold by Sellers on or prior to the Closing Date but only to extent of the reserve for product warranty claims on Sellers balance sheet for the month ended November 30 2015 the Latest Balance Sheet. Example of a Provision. Balance Sheet Balance sheet is a statement of the financial position of a business that list all the assets liabilities and owners equity and shareholders equity at a particular point of time. Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period. A warranty goes on the liability section of a balance sheet. First calculate the number of units the company believes will need to be replaced under warranty. Recorded on the right side of the balance sheet liabilities include loans accounts payable mortgages deferred revenues bonds warranties and accrued expenses.

This matching of warranty expense with the related sales revenue is reasonable since the warranty could be as important in getting the sale as the products advertising expense. When the warranty liability is both probable and can be estimated the accountant will accrue in the period of the sale a liability and an expense for the future warranty work. Some liabilities are not as exact as AP and have to be estimated. Warranty liabilities are usually recognized on the balance sheet as liabilities even when they are uncertain mainly because to show the right value of profits a best estimate is taken and as accounts are maintained under the accrual system in spite of the liability or transaction not having occurred the estimate is. In general a liability is an. A provision stands for liability of uncertain time and amount. Warranty Costs Liability in the Balance Sheet The estimation of warranty cost is a contingent liability and is included in the balance sheet as either a current liability is the warranty period is shorter than 1 year or under long term liabilities if the warranty claims are expected to. Its the estimated amount of time and money that may be spent repairing products upon the agreement of a. It is also the time when the expense is reported The liability will be reduced by the actual expenditures to. These will occur if the goods suffer a fault while under the companys warranty.

Warranty liabilities are usually recognized on the balance sheet as liabilities even when they are uncertain mainly because to show the right value of profits a best estimate is taken and as accounts are maintained under the accrual system in spite of the liability or transaction not having occurred the estimate is. However the warranty can fall under current liabilities or long term liabilities sections depending on whether the warranty duration. Some liabilities are not as exact as AP and have to be estimated. A liability account that reports the estimated amount that a company will have to spend to repair or replace a product during its warranty period. In many cases the after-cost involves a liability whether it. This matching of warranty expense with the related sales revenue is reasonable since the warranty could be as important in getting the sale as the products advertising expense. Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period. They appear on a companys balance sheet and are recognized according to certain criteria of the IFRS. As actual warranty claims are received debit the warranty liability account and credit the inventory account for the cost of the replacement parts and products sent to customers. The danger of the omission of liabilities on the balance sheet and the proper recognition of the correspond ing expense on the income statement is one of the chief problems of income determination.

Recorded on the right side of the balance sheet liabilities include loans accounts payable mortgages deferred revenues bonds warranties and accrued expenses. It is an attempt to take account of the fact that a company may incur future expenses related to goods it has already sold. However the warranty can fall under current liabilities or long term liabilities sections depending on whether the warranty duration. The main use of warranty liability is in a companys accounts specifically its balance sheet. All Liabilities of Sellers with respect to product warranties relating to products sold by Sellers on or prior to the Closing Date but only to extent of the reserve for product warranty claims on Sellers balance sheet for the month ended November 30 2015 the Latest Balance Sheet. That is certainly not a minor obligation. A warranty goes on the liability section of a balance sheet. Units sold the percentage that will be replaced within the warranty period and the cost of replacement. In this example debit the warranty expense account and credit the warranty liability account for 1000. Some liabilities are not as exact as AP and have to be estimated.

Some liabilities are not as exact as AP and have to be estimated. Units sold the percentage that will be replaced within the warranty period and the cost of replacement. It is also the time when the expense is reported The liability will be reduced by the actual expenditures to. Warranty liabilities are usually recognized on the balance sheet as liabilities even when they are uncertain mainly because to show the right value of profits a best estimate is taken and as accounts are maintained under the accrual system in spite of the liability or transaction not having occurred the estimate is. Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period. Warranty liabilities are usually recognized on the balance sheet as liabilities even when they are uncertain mainly because to show the right value of profits a best estimate is taken and as accounts are maintained under the accrual system in spite of the. Why are warranty liabilities usually recognized on the balance sheet as liabilities even when they are uncertain. The liability amount is recorded at the time of the sale. Example of a Provision. They appear on a companys balance sheet and are recognized according to certain criteria of the IFRS.