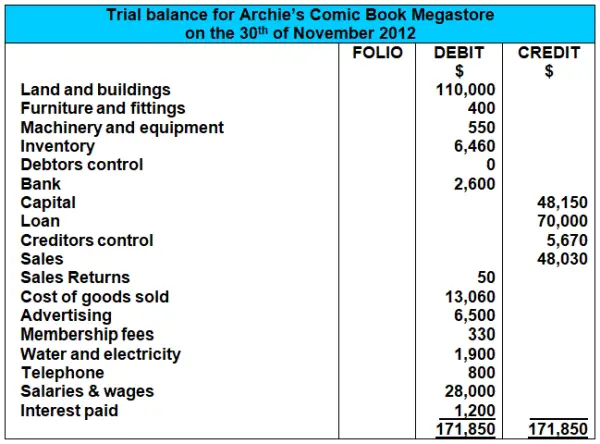

Each accounts balance is listed in the appropriate column. Trial balance helps a professional accountant to balance or check both debit and credit items of income expenses assets and liabilities are correctly recorded or posted. One column is headed Debit and the other column is headed Credit. The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits. The main purpose of a trial balance is to ensure that the list of credit and debit entries in a general ledger are mathematically correct. Trial Balance is a statement summarizing the closing balance of all the ledger accounts prepared with the view to verify the arithmetical accuracy of ledger posting. To the right of the account titles are two columns for entering each accounts balance. The debit and credit sides of trial balance must be equal to indicate that maintenance of the ledger. The post-closing trial balance shows the balances after the closing entries have been completed. The general purpose of producing a trial balance is to ensure the entries in a companys bookkeeping system are mathematically correct.

A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts. The adjusted trial balance is completed after the adjusting entries are completed. The title of each general ledger account that has a balance. The balances are usually listed to achieve equal values in. The post-closing trial balance shows the balances after the closing entries have been completed. Understanding Trial Balance The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. Trial Balance is a statement summarizing the closing balance of all the ledger accounts prepared with the view to verify the arithmetical accuracy of ledger posting. A trial balance lists the ending balance in each general ledger account. The experienced professionals who work at our online accounting firm know how to find and correct a variety of accounting mistakes on a trial balance sheet. Since it is anyhow prepared for a purpose it is put to some other uses like being used in the preparation of final accounts etc.

The title of each general ledger account that has a balance. The purpose of a trial balance in accounting is to help a business correct inaccuracies before the information is transferred to a financial statement. A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts. Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance. The zero items are not usually included. The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits. Trial Balance - Purpose. The post-closing trial balance shows the balances after the closing entries have been completed. Each accounts balance is listed in the appropriate column. This trial balance has the final balances in all the accounts and is used to prepare the financial statements.

The purpose of a trial balance in accounting is to help a business correct inaccuracies before the information is transferred to a financial statement. The balances are usually listed to achieve equal values in. A trial balance consists of the following information. The total dollar amount of the debits and credits in each accounting entry are supposed to match. The post-closing trial balance shows the balances after the closing entries have been completed. This is your starting trial balance for the next year. The general purpose of producing a trial balance is to ensure the entries in a companys bookkeeping system are mathematically correct. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc. The main purpose of a trial balance is to ensure that the list of credit and debit entries in a general ledger are mathematically correct.

The purpose of a trial balance in accounting is to help a business correct inaccuracies before the information is transferred to a financial statement. This is your starting trial balance for the next year. The title of each general ledger account that has a balance. The total dollar amount of the debits and credits in each accounting entry are supposed to match. The balances are usually listed to achieve equal values in. I have achieved a distinction in all my units. The fundamental principle of double entry system is that at any stage the total of debits must be equal to the total of credits. UNIT 8 M2 Explain the purpose of Trial Balance. Purpose of the Trial Balance in Accounting The trial balance is a list of debit and credit balances in the ledger accounts of a business at a given date. In Trial balance all the ledger balances are posted either on the debit side or credit side of the statement.